Finance Minister Nirmala Sitharaman has presented the Budget 2024-25, this is the first budget after coming to power for the third time under the leadership of Prime Minister Narendra Modi. This is the seventh consecutive budget presented by Sitharaman.

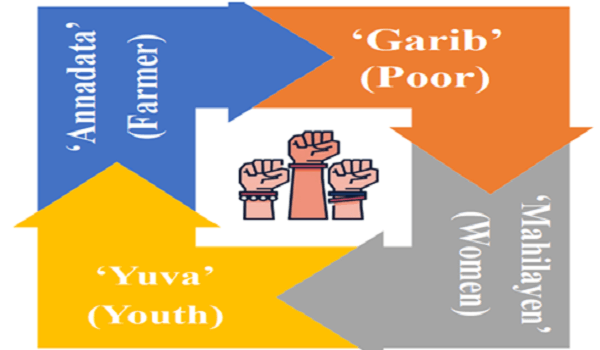

At the beginning of her speech, she said that our focus is on the poor, women, youth and farmers. That is, the four castes, which Prime Minister Narendra Modi has been mentioning. There are many provisions for these four castes in Budget 2024-25. Jobs have also been talked about a lot. Big announcements have been made for industries and start-ups.

Nirmala Sitharaman has said that the government will spend more than Rs 48.20 lakh crore in 2024-25. This is just a budget estimate. Usually, more is spent than what is estimated.The government estimates that for the Rs 48.20 lakh crore it will spend in a year, Rs 31.29 lakh crore will come from taxes. But the government will borrow to meet the rest of the expenses. In 2024-25, the government will borrow Rs 16.13 lakh crore. A large part of the government’s expenditure goes into paying the interest on the borrowing.

Where will it earn from

- If the government earns 1 rupee, 27 paisa will be from borrowings. After this, 19 paisa will come from income tax, 18 paisa from GST and 17 paisa from corporation tax. Apart from this, 9 paisa will be earned from non-tax revenue, 5 paisa from excise duty, 4 paisa from custom duty and 1 paisa from non-debt receipt.

Where will it be spent:

- Out of 1 rupee spent by the government, 19 paisa will go towards paying interest. 21 paisa will be spent towards giving share of tax and duty to the states. Apart from this, 16 paisa will be spent on central and 8 paisa on centrally sponsored schemes. 8 paisa will be spent on defence, 6 paisa on subsidy and 4 paisa on pension. The remaining 18 paisa will be spent on other types of expenses.

Government’s borrowing receipts

- One is domestic debt, which is also called internal debt. In this, the government takes loans from insurance companies, corporate companies, RBI and other banks. The second is public debt, which includes treasury bills, gold bonds and small savings schemes.

- The government also takes loans from IMF, World Bank and other international banks, which is called foreign debt or external debt. Apart from this, if needed, the government can also take loan by mortgaging gold. Like in 1990, the government had borrowed by mortgaging gold.

How much debt is there on the government

- According to the Finance Ministry, till March 31, 2024, the central government had a debt of more than Rs 168.72 lakh crore. Out of this, 163.35 lakh crore was internal debt. Whereas, a loan of Rs 5.37 lakh crore was taken from outside.

- In May this year, Finance Minister Nirmala Sitharaman had said on X that India had a debt of 81% of GDP by 2022. Whereas, Japan had 260%, Italy had 140.5%, America had 121.3%, France had 111.8% and UK had 101.9% debt.

- The Finance Minister had said that the share of short-term debt in India’s external debt is 18.7%, which is much less than China, Thailand, Turkey, Vietnam, South Africa and Bangladesh.

- India currently has a debt of 81% of GDP. This includes the debt of the central government and state governments. However, during the Corona epidemic, this debt increased to 89% in 2020-21.

- After the Corona epidemic, the government had to take more loans. In the Manmohan government, 27 to 29 paise came from loans or borrowings. In the Modi government, it had come down to 20 paise. But the debt increased during the Corona period. In 2021-22, 36 paise of 1 rupee earned by the government was borrowed.

- What difference does taking a loan make? The answer is that it increases the fiscal deficit of the government. In the financial year 2022-23, the fiscal deficit was 6.4% of GDP. This deficit is expected to be 4.9% in 2024-25. The government has set a target of bringing down the fiscal deficit to below 4.5% of GDP by 2025-26.

Nine budget priorities in pursuit of a ‘developed India

- Productivity and resilience in agriculture

- Employment and skills

- Inclusive human resource development and social justice

- Manufacturing and services

- Urban development

- Energy security

- Infrastructure

- Innovation, R&D

- Next generation reforms

Net tax receipts ₹25.83 lakh crore

- Net tax receipts are estimated at ₹25.83 lakh crore. Fiscal deficit is estimated at 4.9% of GDP. Gross and net market borrowings through dated securities are estimated at ₹14.01 lakh crore and ₹11.63 lakh crore, respectively, during 2024-25.

₹1.52 lakh crore allocated to the agriculture sector

- The Finance Minister announced an allocation of ₹1.52 lakh crore for the agriculture sector, which may benefit rural demand for automobiles – especially entry-level two-wheelers and tractors.

- Launching a mission to strengthen the production of pulses and seeds

- Provide 1 month’s salary to all individuals who are new entrants into the formal sector

- New 109 high-yielding and climate-resilient varieties of 32 regional and horticultural crops will be released for cultivation by farmers.

- 1 crore farmers across the country will be involved in natural farming with certification and branding in the next 2 years.

- 10,000 need-based bio-input resource centers will be set up for natural farming.

- Digital Public Infrastructure (DPI) for agriculture will be implemented for coverage of farmers and their land in 3 years.

Angel Tax abolished

- During the full budget speech, Finance Minister Nirmala Sitharaman has announced the abolition of angel tax for investors.

| What is angel tax? When a startup receives an investment from abroad, that investment is considered as income from other sources and a tax of 30 percent is levied on it, which is called angel tax. The amount that a startup raises from an angel investor, more than its fair value, is charged angel tax on that amount. Suppose the fair value of a startup is one crore and it raises Rs 1.5 crore from angel investors, then angel tax will be levied on Rs 50 lakh. What will be the benefit of abolishing angel tax? While imposing the tax in 2012, the government thought that money laundering could be done under the guise of foreign investment. Experts say that abolishing angel tax will make it easier for startups to raise funds. Startups will now be able to spend more on innovation and employment will also increase. Due to angel tax, new startups had difficulty in raising funds and those raising funds from abroad were viewed with suspicion. |

Indirect tax what did the Finance Minister say

- GST has reduced the tax burden on the common man, reduced compliance burden and logistics cost for business and industry. Increased revenue of the central and state government.

‘Ease of doing business’

- To increase ‘ease of doing business’, we are already working on the Jan Vishwas Bill 2.0. Apart from this, states will be encouraged for the implementation of their business reform action plans and digitalization.

Infrastructure Development

- The government will maintain strong fiscal support for infrastructure over the next five years, while balancing other priorities and fiscal consolidation. An allocation of ₹11,11,111 crore for capital expenditure, which is 3.4 percent of GDP, has been made this year.

New Pension Scheme launched

- The committee reviewing NPS has made great progress in its work.

- With a creative approach, a solution will be developed that addresses the relevant issues while maintaining fiscal prudence to protect the common citizen.

Tax Slab 2024 What is the new tax slab:

| Income | update rate |

| 0-3 Lakh | 0% |

| 3-7 Lakh | 5% |

| 7-10 Lakh | 10% |

| 10-12 Lakh | 15% |

| 12-15 Lakh | 20% |

| 15+ Lakh | 30% |

In the new tax regime, now you will get a standard deduction of Rs 75,000 instead of Rs 50,000. If you choose the old tax regime, only income up to Rs 2.5 lakh will be tax free, but under section 87A of the Income Tax Act, you can save tax on income up to Rs 5 lakh.

Long term cap gains to be 12.5% on all financial and non-financial instruments

- Long term cap tax benefit exemption limit raised from Rs 1 lakh to Rs 1.25 lakh. Listed financial assets held for more than 1 year will be long term. Long term capital gains tax raised from 10% to 12.5%.

Mudra loan limit raised to 20 lakh

- Mudra loan limit raised from ₹10 lakh to ₹20 lakh for previous borrowers. Announcement of financial assistance for higher education loans up to ₹10 lakh in domestic institutions. Announcement of integrated technology system for Insolvency and Bankruptcy Code (IBC).

Announcement for flood management too

- The Finance Minister acknowledged that Bihar is frequently affected by floods and noted the lack of progress on plans to build flood control structures in Nepal. The government will allocate an estimated ₹11,500 crore of financial assistance. Assam, which faces floods every year, will get assistance for flood management and related projects. Himachal Pradesh, which faces extensive flood damage, will get support for reconstruction through multilateral assistance.

Training to 25 thousand students

- Finance Minister Nirmala Sitharaman announced during the budget speech that 25 thousand youths will be trained for employment.

Custom duty on gold, silver and platinum

- As part of the Union Budget 2024-25 (on July 23), Finance Minister Nirmala Sitharaman announced major cuts in the basic customs duty on gold, silver and platinum. The customs duty on gold and silver will be reduced to 6%, and the duty on platinum will be reduced to 6.4%.

Research based setup for crops

- Finance Minister Nirmala Sitharaman announced research based setup for increasing productivity and development of climate resistant crops. Developing and releasing new 109 climate resistant crops in 32 categories.

Credit Guarantee Scheme for MSMEs

- Finance Minister Nirmala Sitharaman on MSMEs says, “A credit guarantee scheme will be launched to facilitate term loans to MSMEs. This scheme will work on reducing the credit risks of such MSMEs. A self-financing guarantee fund will provide cover of up to ₹ 100 crore to each applicant.

30 lakh youth benefit in manufacturing sector

- The Finance Minister has announced a scheme to boost job creation in the manufacturing sector by linking it to the employment of first-time workers. The scheme will provide incentives for EPFO contributions to both employees and employers for the first four years of employment. It is expected to benefit 30 lakh youth. The government will reimburse employers up to ₹3,000 per month for two years for the EPFO contribution of each additional employee.

Special focus on women and farmers

- The Finance Minister said that the people have given our government a unique opportunity to take India on the path of strong growth, all-round prosperity. As stated in the interim budget, we need to focus on the poor, women, youth and farmers.

Energy security

- India to develop and R&D small modular reactors.

- Investment-grade energy audit in 60 clusters, expansion to 100 clusters.

- NTPC-BHEL joint venture will set up 800 MW commercial plant.

- Financial assistance to micro and small industries to shift to clean energy forms.

- Provision of free electricity up to 300 units per month for 1 crore households.

- Phase IV of PMGSY: All-weather connectivity for 25,000 rural settlements.

- ₹11,500 crore for projects like Kosi-Mechi inter-state link and other schemes.

- Assistance for reconstruction and rehabilitation in Himachal Pradesh, Assam, Sikkim and Uttarakhand.

What did Andhra Pradesh get in the budget?

- On Tuesday, July 23, Finance Minister Nirmala Sitharaman made a provision of Rs 15 thousand crore from the government for Andhra Pradesh in the budget speech. The Finance Minister announced a budgetary allocation of Rs 15,000 crore in the current financial year on the development of Andhra Pradesh’s capital Amaravati. Special financial assistance will be given through multi-level agencies and understanding the need of the state capital, the central government will also give additional funds in future.

Union budget Bihar gets gift

- Bihar has got many big gifts in Union Budget 2024-25. It also has a gift regarding road-connectivity projects. Union Finance Minister Nirmala Sitharaman, while presenting the budget in the House on Tuesday, has announced to give Rs 26 thousand crore for the construction of Patna-Purnia Expressway and Buxar-Bhagalpur Expressway. Work will start within the current financial year in patches of 100-100 km on both these expressways of Patna-Purnia 300 km and Gaya-Buxar-Bhagalpur 386 km. Finance Minister Nirmala Sitharaman announced an allocation of ₹11,500 crore for flood control measures in Bihar.

Bihar, Jharkhand, West Bengal, Odisha

- The government will provide direct e-vouchers to 1 lakh students every year with an interest discount of 3 percent of the loan amount. Will make Purvodaya Yojana for the all-round development of Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh

Budget Highlights

- Government completely removed customs duty on 3 more medicines for cancer patients.

- Government announced 3 new schemes related to ’employment-related incentives’ in the budget.

- Government will help in interest on loans up to ₹ 10 lakh for higher education.

- FY25 fiscal deficit estimated at 4.9% of GDP.

- Expenditure for FY25 seen at Rs 48.21 lakh crore.

- Target to bring fiscal deficit below 4.5% by next year

- Receipts for FY25 seen at Rs 32.07 lakh crore.

- TDS rate on e-commerce operators reduced from one per cent to 0.1 per cent.

- According to Budget 2024-25, the government plans to complete a comprehensive review of the Income Tax Act, 1961 in 6 months.

- Finance Minister Nirmala Sitharaman has allocated Rs 3,442 crore to promote sports in the country in the Union Budget 2024-25. Out of which Rs 900 crore has been kept for the ‘Khelo India’ initiative.

Deficits of the Government of India

| Provisional estimates 2023-24 | Budget Estimates for 2024-25 | |

| Fiscal Deficit | 5.6 | 4.9 or Rs `16.13 lakh crore |

| Revenue Deficit | 2.6 | 1.8 |

| Primary Deficit | 2.0 | 1.4 |

| Tax Revenue (Gross) | 11,7 | 11.8 |

| Central Government Debt | 58.2 | 56.8 |

Railway Budget presented as part of the Union Budget

Allocation

- The total allocation for 2024-25 is Rs 2,52,000 crore, compared to Rs. 2,40,200 crore in 2023-24, a growth of around 5%.

- The budgetary allocation for railways has remained the same since Nirmala Sitharaman presented the interim budget 2024-25 just before the general election 2024.

Railway Safety

- Out of the total allocation, Rs 1.08 lakh crore will be spent on measures to boost railway safety. The money will be used to upgrade old railway tracks, improve Indian Railways’ signalling systems, create flyovers and underpasses, and install the Kavach system on the Indian Railway network.

- The Kavach system has been developed indigenously. In the Kavach system, electronic devices are installed in train engines, signalling systems, and rail tracks to control the brakes of trains and alert drivers. The system automatically engages the train’s braking mechanism if a train exceeds a designated speed limit and the driver fails to intervene.

Provision regarding Railway Track

- Allocation for track renewal in 2024-25- Rs 17,651.98 crore.

- Allocation for gauge conversion -4,719.50 crore.

- Allocation for converting single line track into double line track- Rs 29,312.19 crore.

- Allocation for building new railway lines – Rs 34,602.75 crore. Railways aims to lay 2,000 km of new tracks.

- The Indian Railways has commissioned 31,180 kilometres of track in the past decade. In 2013-14,4 kilometres of track were laid down daily, which has now increased to 14.54 kilometres per day in 2023-24.

Electrification of Railway Track

- From 2014 to 2024, the Indian railway electrified 41,655 Route Kilometers (RKMs), while only 21,413 RKMs were electrified until 2014.

- The railway ministry aims for 100 per cent electrification of its broad gauge network by July 2024.

History of electrification of the rail route

- The first electric train ran in India on 3 February 1925 between Bombay VT(now Chhatrapati Shivaji Maharaj Terminus) and Kurla Harbour in Mumbai.

- After independence, the first route to be electrified was the Howrah – Burdwan section in West Bengal in 1958.

Railways Financial Performance

- The Operating Ratio target for the Indian railways in 2024-25 is 98.22 per cent, compared to 98.65 per cent achieved during the 2023-24 financial year.

- The operating ratio is the number of rupees spent by railways to earn every 100 rupees. If the Operating ratio is less than 100, then the railway is in profit, and if it is above 100, then the railway is in loss.

- The lower the operating ratio, the more efficient the railway.

- The railway’s total revenue in 2023-24 was Rs 2.40 lakh crore, and its total expenditure was Rs 2.26 lakh crore. Railways was in profit during 2023-24.

- The Revenue generation target from the Passenger segment in 2024-25 is Rs 80,000 crore (Rs 73,000 crore in 2023-24).

- The revenue generation target from freight transportation in 2024-25 is Rs 1,74,500 crore(in 2023-24, it was Rs 1,64,700 crore, less than the target set for the financial year).

Target for Freight Loading

- The Indian railways earn profit from goods trains or freight train services, while the passenger service is loss-making.

- In 2023-24, the railways achieved a freight loading of 1588 MT. The Indian Railways has set a target of 3000 MT of freight loading by 2030.

- The Dedicated Freight Corridor will help the railway achieve this freight loading target.

Dedicated Freight Corridor

- Allocation to the Dedicated Freight Corridor Corporation of India (DFCC) for 2024-25: Rs 8,155 crore (Rs 27,482 crore last year).

- The funds will mainly be used to complete the construction of the Western Dedicated Freight Corridor.

- The Railway Budget 2005-06 announced the Dedicated Freight Corridor project. It proposed the creation of a separate railway track for goods trains on which freight trains can run at an average speed of more than 75 km per hour.

- The Railway Ministry established the Dedicated Freight Corridor Corporation of India Limited (DFCCIL) in 2006 to implement the project.

The dedicated freight corridor has two components: Eastern and Western freight corridor

Eastern Freight Corridor –

- The total length is 1856 km.

- It connects Dankuni (West Bengal) to Ludhiana (Dhandarikalan) in Punjab.

- It crosses six states: West Bengal, Jharkhand, Bihar, Uttar Pradesh, Haryana, and Punjab.

- According to the Indian Railway, it has become operational.

Western Freight Corridor

- It is 1506 km long.

- It connects Dadri (Uttar Pradesh) to JNPT port Mumbai(Maharashtra).

- It crosses through five states -Maharashtra, Gujarat, Rajasthan, Haryana, and Uttar Pradesh.

- It is almost 93.2 per cent complete and is expected to become fully operational in 2024-25.

- Japan and the World Bank are the major funders of the Dedicated Freight Corridor project in India.

New Freight Corridor

In the 2010-11 Railway budget, the government announced three more dedicated freight corridors

- East-West Corridor (Palghar-Bhusawal-Dankuni Approx 2106 Km & Rajkharsawan-Andal 200 Km)

- North-South Corridor (Itarasi-Vijaywada) Approx 931 Km

- East Coast Corridor (Kharagpur-Vijaywada) 1078

2,500 passenger Coaches

- The Railway Ministry announced the construction of 2,500 new passenger coaches in 2024-25.

- The Railway Minister Ashwini Vaishnaw announced the construction of more than 10,000 2,500 new passenger coaches.